Home → Blog → Energy concepts → What is curtailment?

By

Karina Rosario Peguero

Published on:

06/09/2024

As the energy sector transitions towards the integration of more renewable energy sources, like wind and solar, the task of efficiently managing imbalances and congestion in the electricity grid becomes increasingly challenging for grid operators, and prices on energy markets sometimes turn into the negative territory, which can affect energy producers.

One solution for both grid operators and energy producers is the intentional reduction of power generation – also called “curtailment”.

Turning off production may sound contradictory at first, but it offers significant advantages for both. In this article, we will explain what curtailment is, its benefits, and how it can be implemented.

I. Defining curtailment

In the energy sector, curtailment means to temporarily shut down or limit the amount of power that energy assets, such as wind turbines or solar panels, can produce.

This may be necessary to prevent grid imbalance in times when there is more supply than demand, for example, when there is an excess of green energy because of strong wind currents or many hours of bright sun and not enough demand. But it can also be used to tackle local grid congestion, which occurs when the same excess of green energy overloads the grid (requesting more transmission capacity than what the grid can handle).

Not sure about the difference between imbalance and congestion? We explain everything in this article.

Thus, requesting curtailment is a strategic way for grid operators to keep the grid balanced, non-congested and, in extreme cases, avoid blackouts. But it also offer benefits for asset owners who can use it as an extra source of revenue.

Curtailment can be used by energy producers (via their aggregator) to avoid negative prices (day-ahead or imbalance) and optimize their returns, or through a capacity limiting contract (CBC) to help their grid operator in solving congestion in exchange for a compensation.

II. Benefits of curtailment

- Revenue optimization for producers:

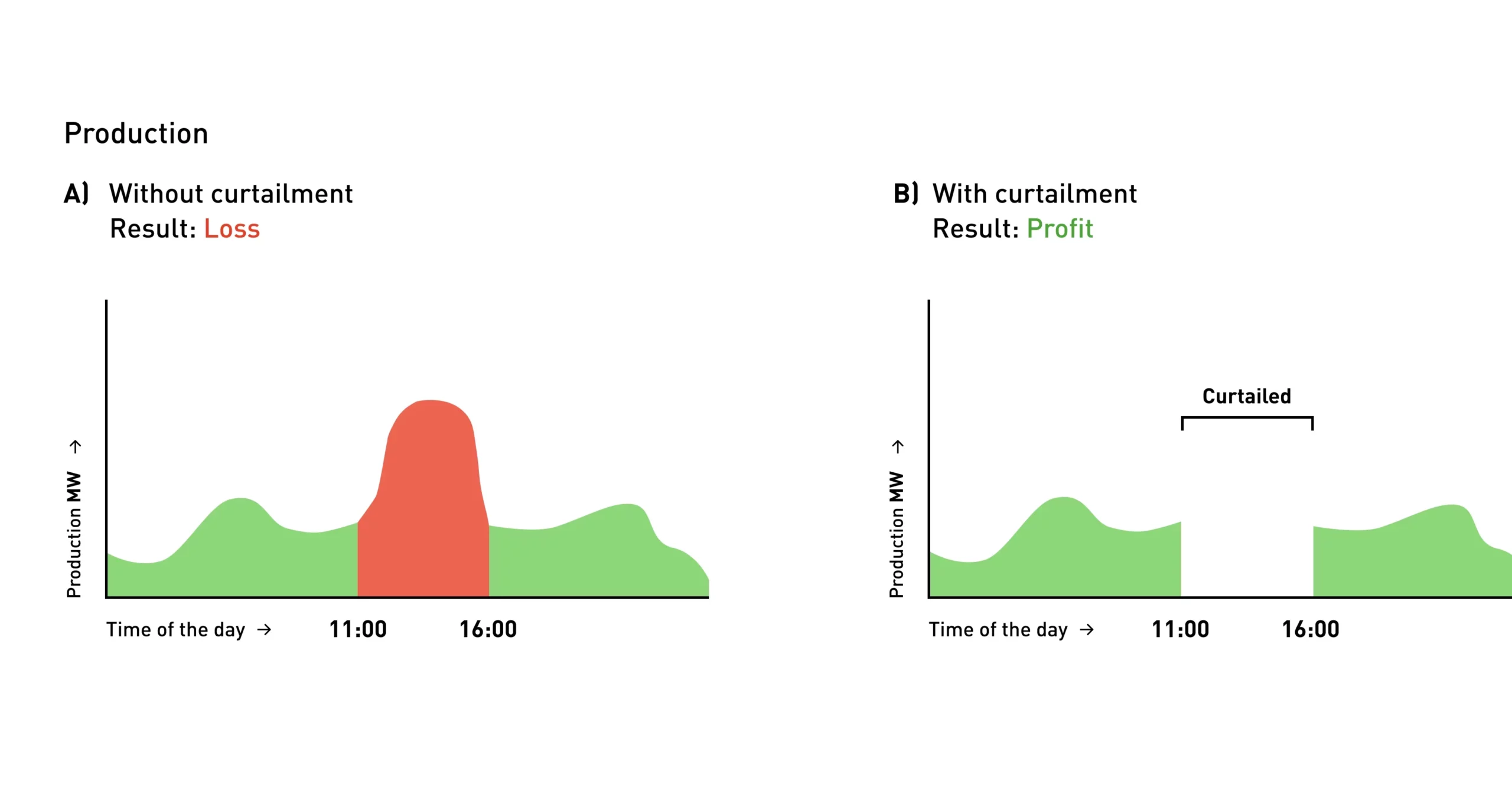

- When there is a surplus of electricity on the energy grid (forecasted or in real-time), market prices tend to go low or become negative. In this case, curtailment helps renewable energy producers to avoid feeding-in power and paying for it. In some cases, producers can also make a profit if, by curtailing, they help the system return to balance (see example below).

- Producers who have a Capacity Limiting Contract (CBC) to help relieve congestion will receive compensation for their missed generation every time the contract was activated by their grid operator.

- Grid stability and efficiency for grid operator:

By requesting curtailment (via market incentives or contracts) to balance supply and demand and manage congestion, grid operators can prevent power outages and ensure reliable service.

- Contributing to the clean energy transition:

Applying curtailment increases the utilization of available grid capacity for renewable energy. By curtailing excess power (e.g. in the summer) more renewable generation can be connected which increases the share of renewables over the whole year.

III. Applying curtailment

The two main reasons why curtailment is applied are to ensure asset owners receive revenue instead of losses, and to prevent an overload in the electricity grid.

1. Curtailment for revenue optimization – Dynamic contract based on EPEX prices

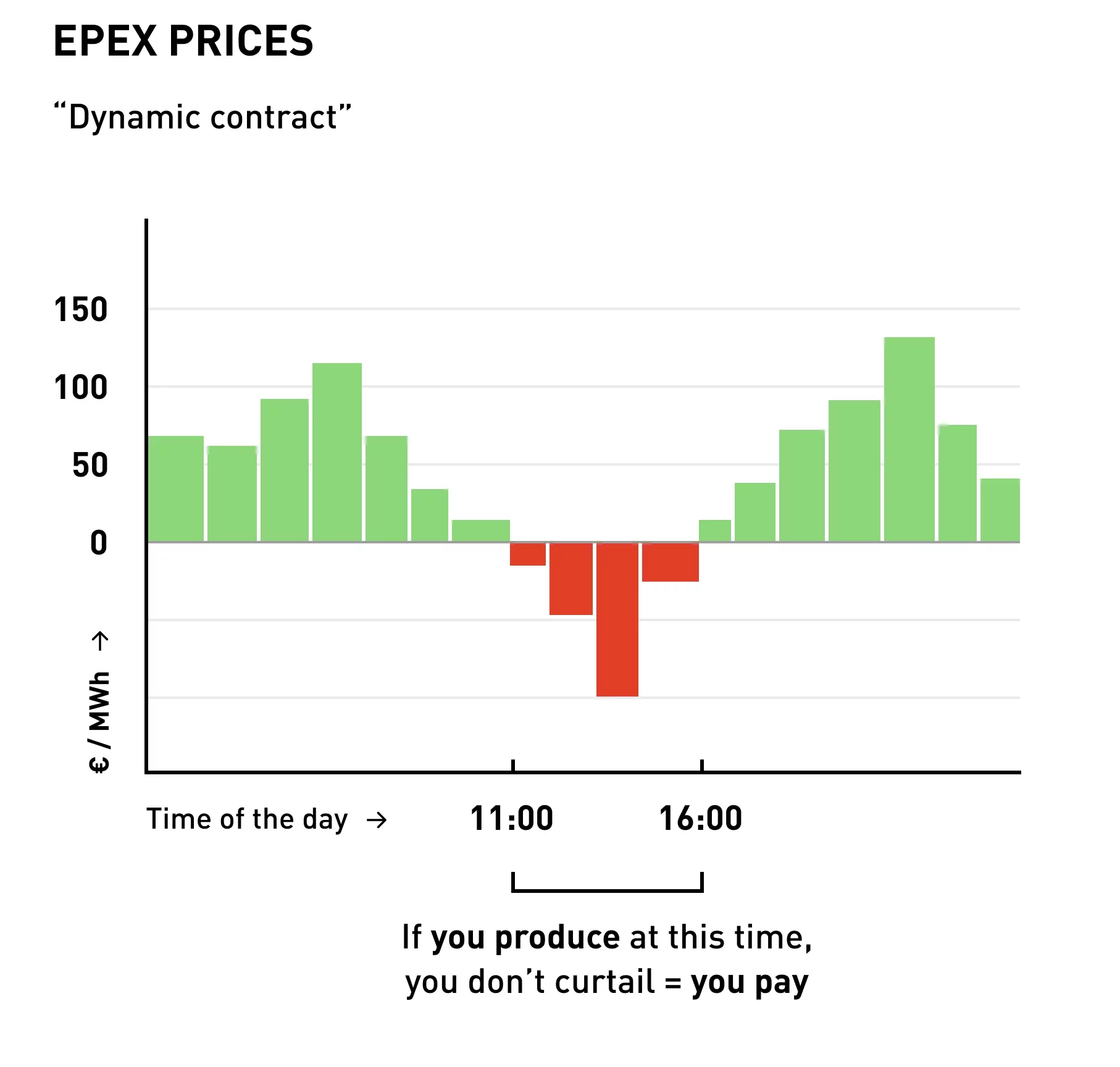

Energy prices are determined by the forecast of supply and demand of the following day; these 24 day-ahead hourly prices are also known as EPEX (European Power Exchange) prices.

Those EPEX or day-ahead prices are then applied in dynamic power contracts, by doing this producers get an economic incentive in exchange for curtailing their production.

These dynamic contracts are designed to provide flexibility and adaptability to changing market conditions, but they come with their own complexities, especially when EPEX prices take an unexpected turn – into the negative territory – and producers have to pay to feed-in, that is when curtailment becomes necessary.

When the day-ahead market anticipates an abundance of renewable energy generation, and at the same time, demand will be low, negative EPEX prices become common.

If producers don’t curtail, they have to pay for the surplus electricity feed-in onto the grid during the anticipated times of oversupply.

2. Curtailment for revenue optimization – Imbalance

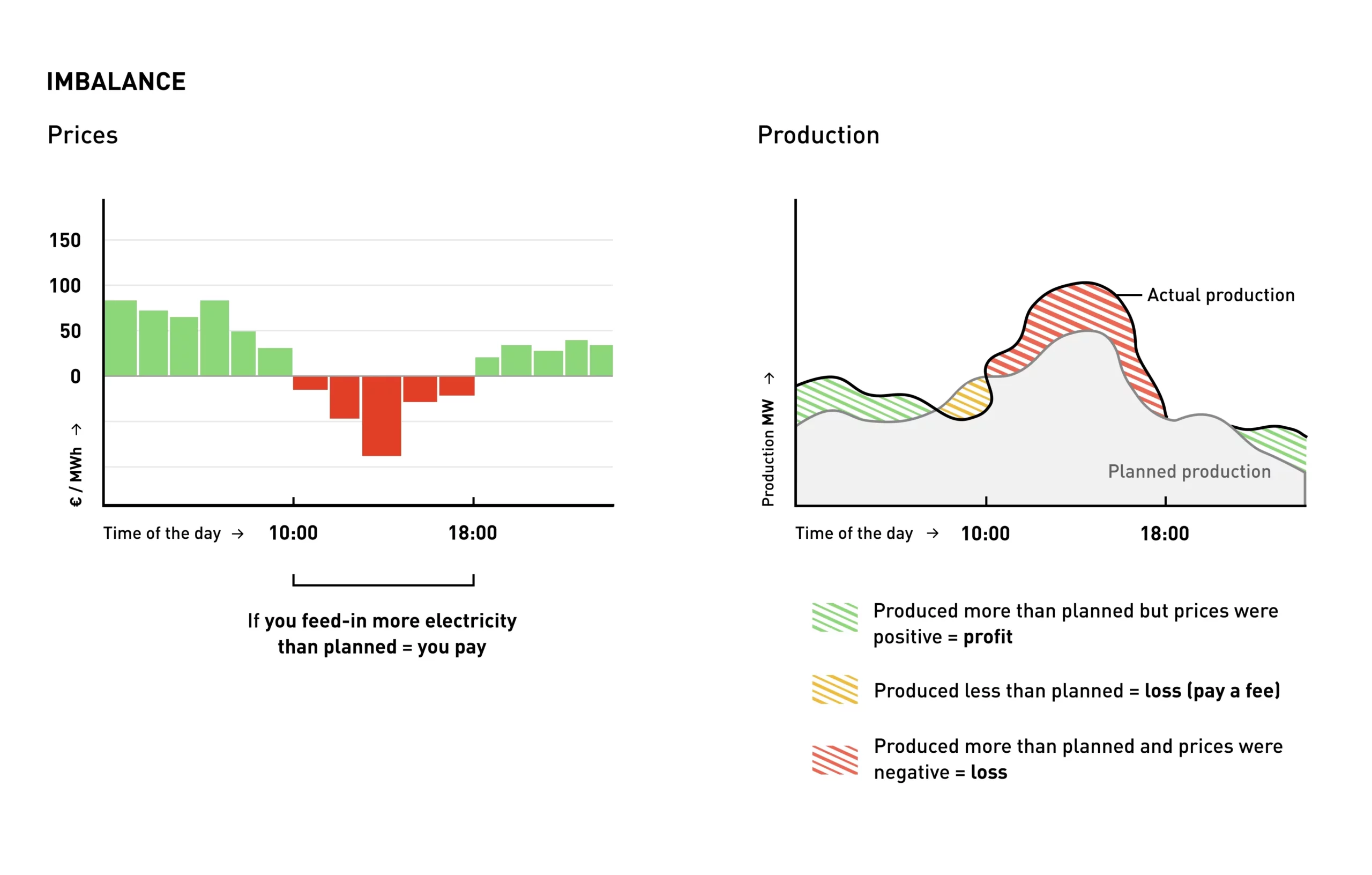

To ensure that supply and demand are met without compromising the electricity grid frequency, every energy producer or consumer connected to the grid must be associated with a Balancing Responsible Party (BRP), which is responsible for predicting and adjusting the supply and demand of electricity in their portfolios.

Every day, BRPs submit a forecast of the planned production and consumption in their portfolio to TenneT (TSO in the Netherlands).

However, as renewable energy sources like solar and wind depend on weather, it is challenging for BRPs to accurately forecast the energy supply, often leading to inconsistencies between the expected and actual production. These inconsistencies create imbalances that TenneT needs to rectify. For each rectification, TenneT will then invoice the BRPs the imbalance price. Sometimes, the BRPs bear the imbalance risk and make the producers pay a premium fee for it, sometimes the producers bear the risk themselves. The imbalance fee can be sometimes pricey for whoever bears the imbalance risk (the BRP or the producer).

So when their production is higher than expected, and when imbalance prices to supply are negative, producers bearing the imbalance risk can curtail their output to avoid financial losses and optimize their revenue.

Imagine a solar park on an unexpected sunny day; the park generates more electricity than predicted for that day. However, it’s not the only park in that case. At a national level, there is an excess of solar energy supply which creates imbalance on the grid, pushing imbalance prices down for producers. This means that any producer feeding-in more than necessary will have to pay, as it contributes to the instability of the system. In this case, the solar park owner can curtail its output. Not only will they avoid paying to feed-in, but they can also receive money out of it by choosing to not produce at all. By reducing the excess supply, they help stabilize the system and are compensated for doing so.

The strategic use of curtailment not only supports grid stability but also enhances the financial returns for the asset owner as prices fluctuate based on the supply-demand dynamics, and the delivery time of energy, either by the day-ahead market or at real time in the imbalance market.

3. Curtailment during grid congestion

Grid congestion occurs when the electricity generation or demand in a particular area exceeds the capacity of the local transmission infrastructure, and if there is a lack of capacity in a certain area, then no additional connections are allowed.

Grid congestion is similar to a traffic jam: when too many cars try to enter a road that is not designed for heavy traffic, everything gets stuck, leading to long waiting times before any new cars can get in.

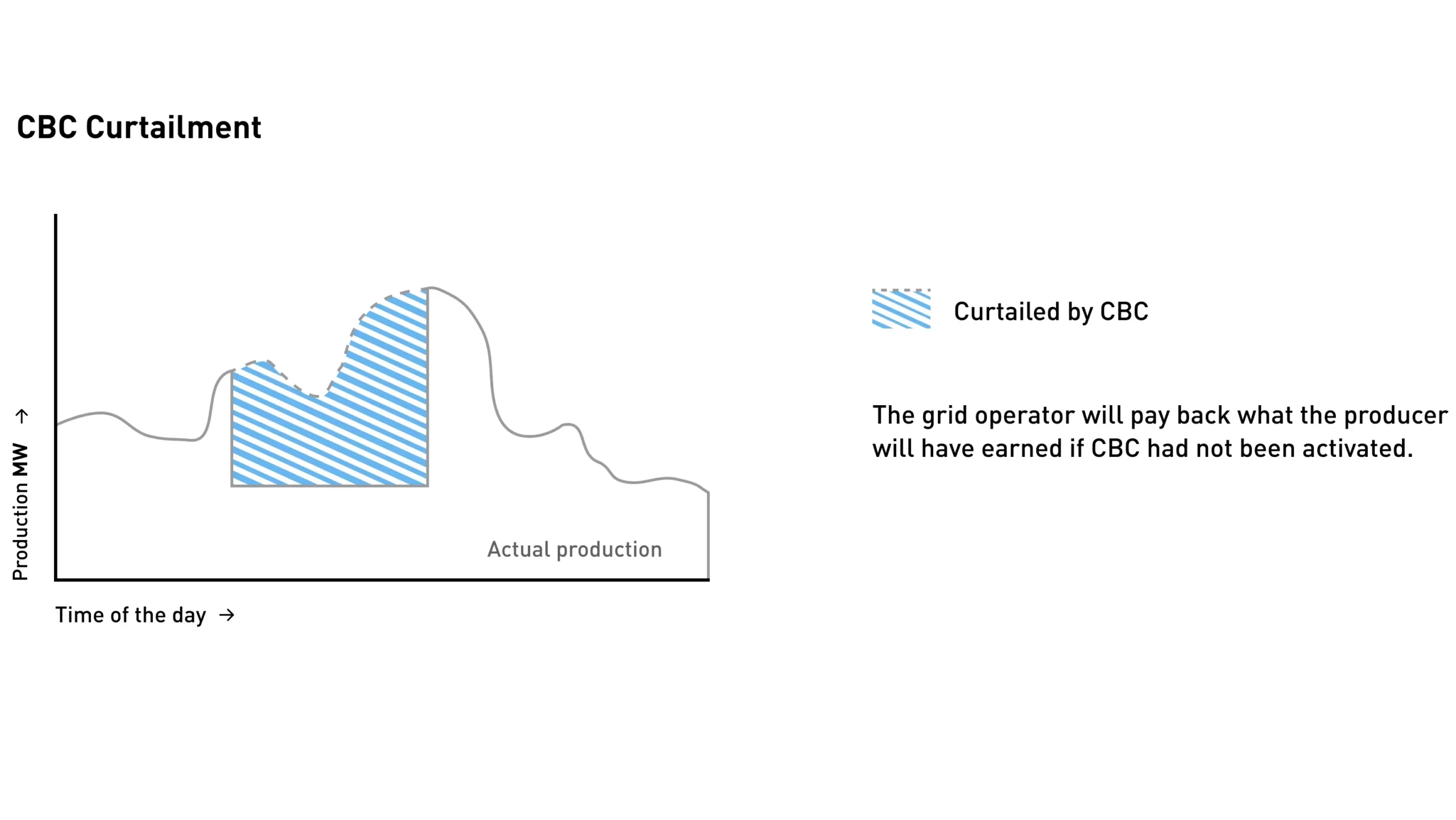

To manage congestion, grid operators can offer asset owners a Capacity Limiting Contract (CBC), so they can curtail their assets when necessary, obtaining compensation for missed generation.

Consider a wind farm on a particularly windy day; the wind turbines generate electricity at full capacity, but the local grid infrastructure cannot handle this level of output. In this case, the grid operator sends a signal to curtail the output of this wind farm temporarily. Although the wind farm produces less electricity, it helps prevent grid congestion and maintains system reliability. The wind farm operator will receive compensation for this curtailment.

The Teleport: your gateway to enable curtailment

By implementing curtailment, asset owners can optimize their revenues while contributing to a more stable and efficient grid.

At Withthegrid, we offer asset owners and their aggregators a tool to unlock the flexibility and profitability of their energy assets. The Teleport connects to your PV system or wind turbine, and enables curtailment control commands, so that asset owners no longer supply electricity when prices are negative and/or can make sure their CBC limits are respected.

→ Discover the Teleport now

Want to apply curtailment and get control of your assets?

Withthegrid can help you apply curtailment. Start the conversation with our team today!