Home → Blog → Negative Prices → Negative energy prices: EPEX day-ahead, imbalance, risk mitigation

By

Anaïs Wampack

Published on:

08/12/2023

In the world of energy production, two crucial concepts often come into play — EPEX day-ahead prices and imbalance prices. These terms are fundamental to understanding how the system set up to maintain grid balance operates and influences the prices of energy supply. In this article, we will delve into the key distinctions between EPEX day-ahead prices and imbalance prices and explore their respective potential impact on energy producers.

EPEX day-ahead market: anticipating tomorrow

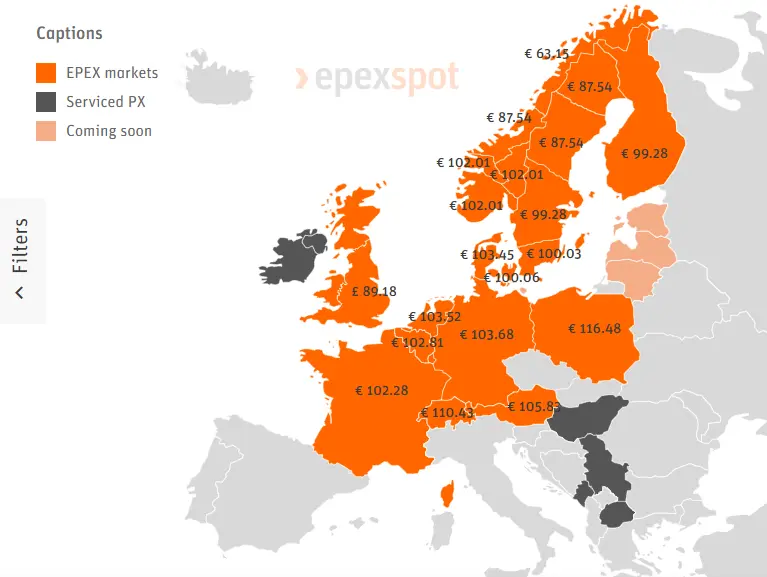

EPEX Spot is a leading power exchange in Europe, facilitating the trading of electricity across various countries. The day-ahead market is a crucial component of EPEX Spot, where Balancing Responsible Parties (BRPs, the market participants) buy and sell electricity for delivery on the following day in order to keep their portfolio in balance.

The day-ahead prices are determined through a competitive auction process. Each day, BRPs submit bids on the day-ahead market based on forecasted demand and supply conditions. At noon, the order book closes and the market is said to be ‘cleared’:

- The system matches bids and offers based on prices, volumes and delivery period, aiming to minimize the overall electricity cost while meeting demand.

- The market clearing price (which is the ‘day-ahead EPEX price’) is the price at which the total quantity of electricity demanded equals the total quantity supplied for a specific delivery period. In other words, it’s the price at which the market is balanced. This price is set by the last accepted bid.

- Once the market is cleared, participants whose bids were accepted receive or pay the market-clearing price for the electricity they bought or sold. This market-clearing price is the same for all participants, and it is the basis for the settlement of transactions.

Imbalance prices: keeping accountability

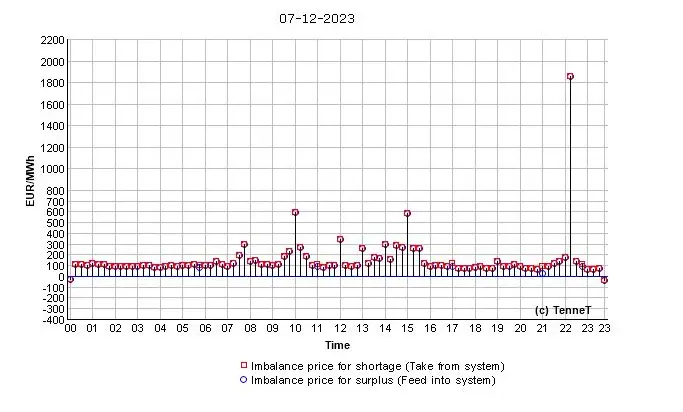

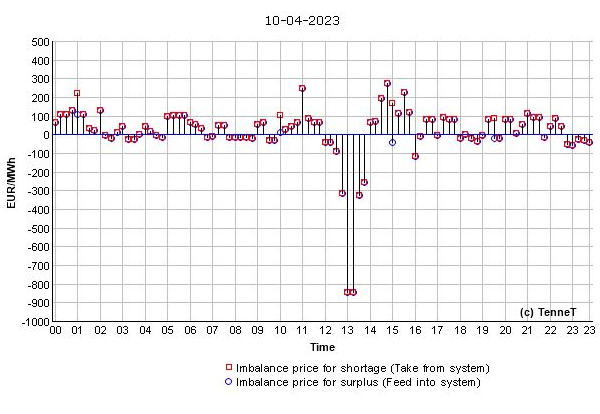

While the day-ahead prices are related to the next day’s electricity transactions (based on forecasted supply and demand), the imbalance prices are linked to the real-time operation of the power system.

To enforce the principle of ‘balancing responsibility’, the BRPs must submit to TenneT information about the scheduled amount of energy generation and consumption of their portfolio. If they deviate from these programmes during real-time (also called, the settlement period) in a way that does not help the system, they have to pay for their imbalance. On the other hand, if it helps the system, they can receive money.

The imbalance prices reflect the cost of TenneT intervention for balancing the system (with the activation of other balancing products such as FCR, aFRR…) due to deviations from the BRPs scheduled plans. Those costs are passed to BRPs, who are financially settled based on the calculated imbalances of their portfolio and the corresponding imbalance prices.

This system encourages responsible behaviour and contributes to the overall reliability of the electricity grid.

The case of negative prices: a challenge for energy producers

While Balancing Responsible Parties (BRPs) play a crucial role in maintaining grid balance, energy producers face their own set of challenges, particularly when operating under dynamic contracts based on EPEX day-ahead prices or when bearing the imbalance risk.

Negative electricity prices

Negative prices occur when the supply of electricity exceeds demand to such an extent that producers end up paying consumers to take the excess energy off the grid. This phenomenon is not uncommon and is often observed during periods of high renewable energy generation, such as strong winds leading to increased wind power output.

While negative prices benefit consumers, they present a significant challenge for energy producers, especially in two situations:

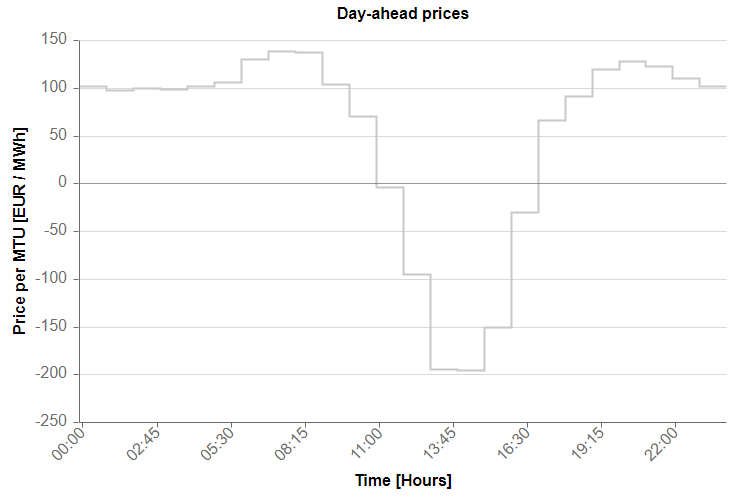

1) Dynamic contracts indexed on EPEX day-ahead prices

As a producer, you might have a dynamic contract based on EPEX day-ahead prices. These dynamic contracts are designed to provide flexibility and adaptability to changing market conditions, but they come with their own complexities, especially when EPEX prices take an unexpected turn – into the negative territory – and producers have to pay to feed-in.

2) Imbalance risk

When you sign a contract, you have the choice to bear your imbalance costs yourself, or to buy them off. When you buy off the imbalance costs, you pay a fixed premium amount, and the risk of imbalance costs then lies with your energy supplier. Negative imbalance prices do not affect you directly if you produce more than planned. But if you have the imbalance risk and the imbalance costs are negative (also due to excessive power supply compared to demand), you will have to pay for feeding-in more electricity than forecasted.

Negative prices in those two cases pose financial risks for you, as you not only miss out on anticipated revenue but also face unexpected costs. This is called the cannibalisation effect and poses a big risk for producers.

Mitigating negative prices risks

Addressing the challenge of negative electricity prices requires innovative solutions that empower you to navigate these complex scenarios. Here are two potential strategies for you to consider:

1) Curtailment

Curtailment involves intentionally reducing or limiting the production of electricity, particularly during periods of oversupply. By scaling back generation when prices are negative, you can avoid the financial burden of paying consumers to offload excess energy. You can also use it to earn money: if you curtail your production – produce less than planned – in case of over supply in the system (negative imbalance prices), you can receive the imbalance price.

Is curtailment a solution for you? Check your potential savings:

2) Energy Storage Solutions

Investing in energy storage systems, such as batteries, provides you with the ability to store excess energy during times of surplus and release it when demand is high and prices turn favorable. This approach allows you to capitalize on periods of negative prices by storing energy for later use, thus avoiding the need to pay consumers to take the excess electricity.

Conclusion

In conclusion, the distinction between EPEX day-ahead prices and imbalance prices is crucial in understanding energy supply prices. The EPEX day-ahead market anticipates and sets prices for the next day’s transactions through a competitive auction, while imbalance prices enforce real-time grid balancing.

Negative electricity prices pose challenges, especially for producers under dynamic contracts or bearing imbalance risk. To mitigate these risks, curtailment—intentionally reducing production during oversupply—and investing in energy storage solutions, like batteries, offer strategic options.

specialized in smart flexibility solutions

Want to unlock the flexibility of your assets?

Withthegrid is here to assist you – contact us today!

Or check the use cases of the Teleport.